Why Facility Management Software For Schools Is Essential For Streamlining Operations and Maximizing Resources

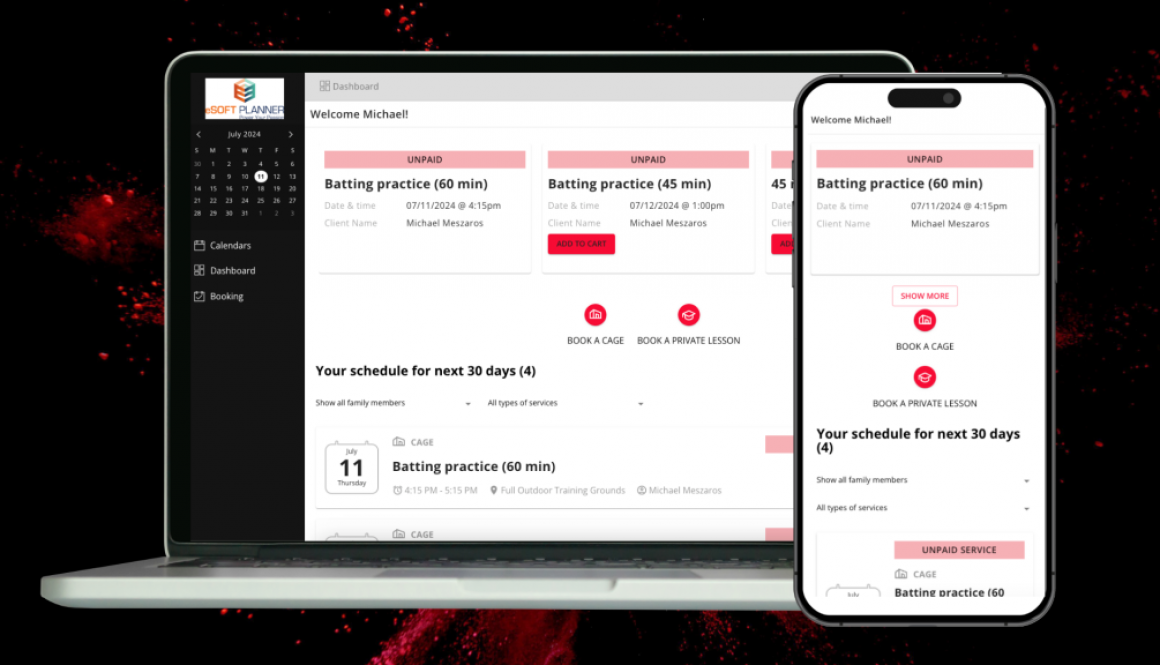

Facility management software for schools can be a game-changer, helping schools streamline their operations, reduce administrative time, and improve communication across multiple departments. eSoft Planner’s leading software solution can transform the way schools manage their facilities.

Why Facility Management Software For Schools Is Essential

Schools are more than just educational spaces. They include fields, gyms, auditoriums, and classrooms. Students and staff regularly utilize these spaces. However, the school can also rent these spaces out to members of the community as extra revenue for the district. For example, in this Kentucky survey, 74% of school facilities are open after school hours for community use. Usually, these spaces have different rules for how they can be used by the general public versus members of the department. Schools need a streamlined process to manage these spaces and their rules.

There are several essential features that can improve your school’s space management significantly, including:

- Streamlined Communication Between Departments: A management system should have a centralized calendar with real-time updates. With this, there is no worry about miscommunication between multiple departments about the schedule.

- Enhanced Security For the School: The school can require customers to sign a waiver during their account creation when renting out spaces. This protects the school from liability for any injuries during the rental.

- Customized For Your School Needs: We can customize each space to fit your needs, from set hours to special dates. The school will set up the system however they want to schedule – a locked-down system for only school administrators, an invite-only system, or an open system for community scheduling.

Streamlining Your School’s Schedule

Administrators can implement priority scheduling within their scheduling system to ensure that staff and school-related activities are scheduled first before community events. For example, members of a school team can easily schedule their weekly practices in the gym. If no one reserves that time a certain number of days before that date, it opens to members of the community to rent. When the school sets up e-commerce, it can collect payment in advance of rentals to improve its cash flow.

Another customizable scheduling feature is the ability to set locations by hours. With this, a school can define the specific operating hours for each space within the school. For example, classrooms might be available from 6-8 pm, while fields are available from 4-10 pm. This flexibility allows schools to rent out all their spaces at the times that best fit their schedule.

Conclusion

Facility management software for schools is essential, streamlining the operations of the school and maximizing your resources. It will also enhance communication throughout multiple departments at the school. Request a custom demo of our software to learn more about how this software can benefit your school!